Author/Source: Ryan S. Velez / CNBC Select See the full link here

Takeaway

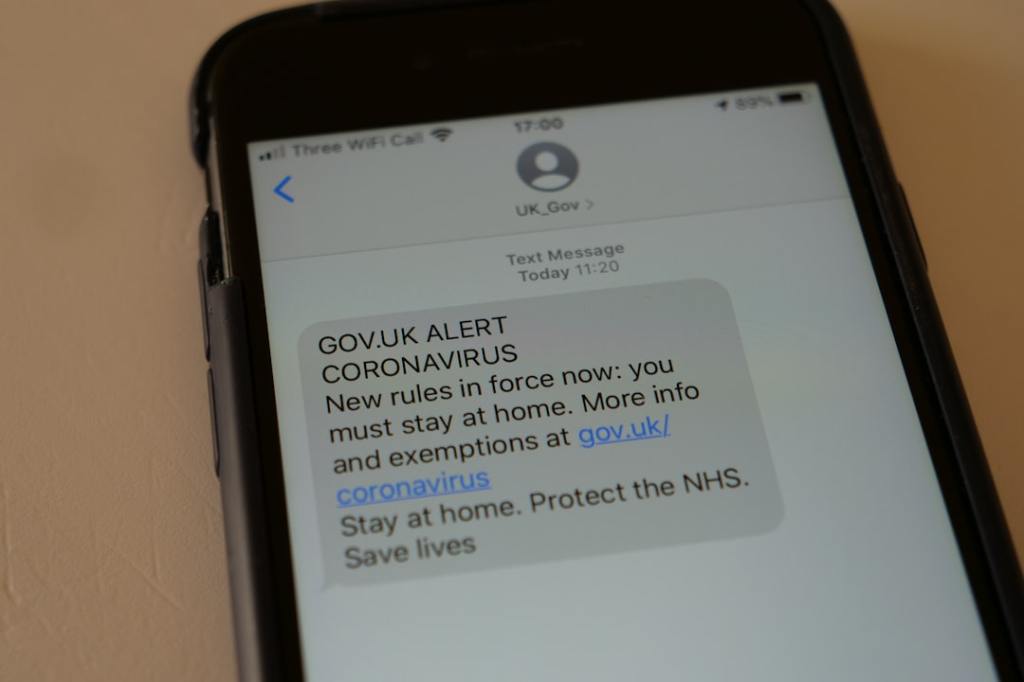

This article highlights that the earliest indicator of a scam is usually an unexpected and unsolicited message, whether it’s an email, text, or phone call. It emphasizes that scammers often create a sense of urgency or fear, urging recipients to verify the authenticity of any such communication by directly contacting the organization through official channels.

Technical Subject Understandability

Beginner

Analogy/Comparison

Imagine someone you’ve never met suddenly knocking on your door claiming to be a delivery person with an urgent package you didn’t order. Before opening the door or handing over anything, you’d want to check their uniform, the company truck, or even call the delivery company directly to confirm their identity and the package’s existence.

Why It Matters

Understanding the initial signs of a scam is crucial because it helps people protect their money and personal information. For instance, if you receive a text message pretending to be from your bank asking you to click a link to resolve a “suspicious activity” alert, recognizing this as an unsolicited message can prevent you from clicking the malicious link, which could lead to your account being compromised.

Related Terms

Phishing Smishing Vishing Social engineering Impersonation Urgency tactics

Jargon Conversion: Phishing: Scammers sending fake emails to trick you into revealing personal information like passwords or bank details. Smishing: Similar to phishing, but using text messages instead of emails. Vishing: Using phone calls, often with recorded messages, to try and get personal information. Social engineering: Manipulating people into performing actions or divulging confidential information. Impersonation: Pretending to be someone else, like a bank or government official, to gain trust. Urgency tactics: Creating a false sense of immediate need or danger to pressure someone into making quick, unverified decisions.

Leave a comment